Answer:

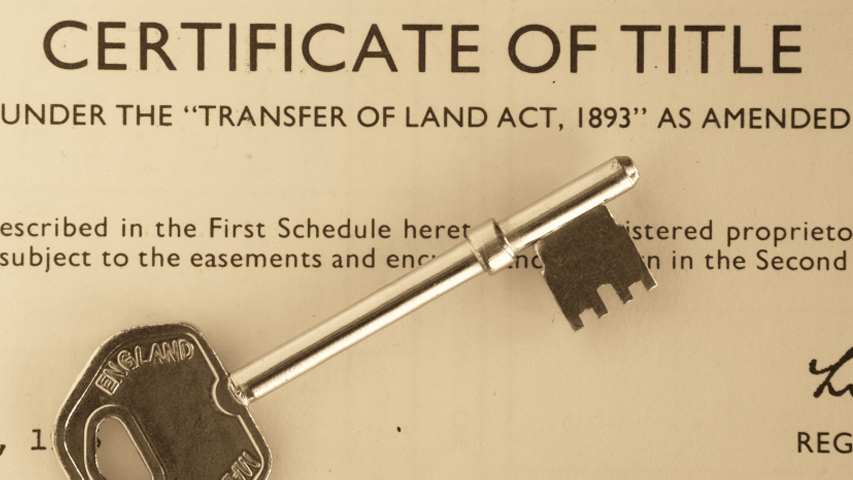

A certificate of title is issued by a title company and states that the seller has a clear, marketable and insurable title on the property.

Basically, it’s a form of documentation that proves a given seller actually owns the property that they have listed for sale.

A certificate of title offers some measure of protection for a buyer, but a title insurance policy offers considerably more. For instance, it does not cover any hidden defects that the title company could not discover by examining the records.

Title insurance, on the other hand, protects buyers from claims of ownership by third parties others as well as liens and other claims against the property that the buyer is not aware of when they purchase the home.